IRA Qualified Charitable Distributions

Traditional or Roth IRA owners who are 70½ years or older can make qualified charitable distributions (a.k.a. IRA charitable rollovers) up to $100,000 each year to qualified charities like ICR. Such gifts are free from federal income tax and may count toward required minimum distributions. What an excellent opportunity to practice good stewardship and support those tax-exempt organizations God has laid on your heart!

To qualify as a tax-free gift, the gift must be distributed directly from the IRA administrator to ICR. If this opportunity is right for you, please contact your IRA administrator and provide the following information:

- Legal name: Institute for Creation Research

- Federal Identification Number: 95-3523177

- Physical Address: 1806 Royal Lane, Dallas, TX 75229

- Mailing Address: P.O. Box 59029, Dallas, TX 75229

A NEW IRA BENEFIT: IRA to Charitable Gift Annuity Rollover

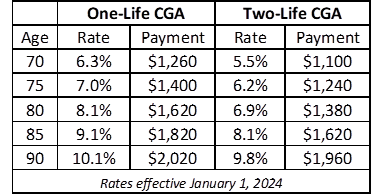

The Secure 2.0 Act allows a one-time rollover of $53,000 from an IRA to an immediate charitable gift annuity. There can be no additions of other assets. The CGA payouts must either benefit the IRA owner or the IRA owner and spouse.Here are the new CGA rates:

For more information about this or other ways to support ICR’s ministry, call 800.337.0375 or email us at stewardship@icr.org.