With a healthy economic outlook and the stock market soaring, this may be a wise time to consider safer havens for some of your resources. This is especially true for seniors living on fixed incomes who need to protect their assets. But rates for traditional sources of guaranteed income, such as certificates of deposit and savings accounts, are woefully low and simply are not an attractive option. A much better alternative for senior supporters age 65 or older can be found in ICR’s Charitable Gift Annuity program.

Charitable gift annuities, also known as CGAs, are planned giving instruments that involve a simple contract between ICR and the donor. But unlike other financial arrangements, these special annuities offer additional benefits unmatched by other secure investments. In exchange for a gift of cash or stock, ICR provides a partial income tax deduction and a guaranteed fixed income stream for life—a portion of which is paid tax free.

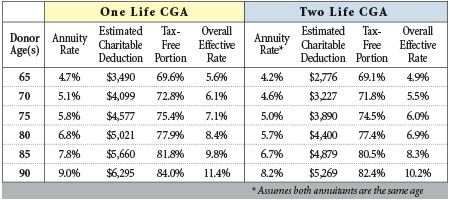

The amount of the fixed income stream is determined by several factors, but the donor’s age plays the biggest part. The older you are, the higher the rate—just one of many benefits to growing older! The maximum number of annuitants per contract is two, and payments can begin immediately or can be deferred to some future date. And once the donor passes, ICR keeps the remainder of the gift and applies it to our ministry.

Charitable gift annuities could be right for people who desire to do any of the following.

- Increase cash flow over low interest rates in CDs and other fixed income investments.

- Avoid capital gains tax on appreciated stock or mutual fund shares while generating more predictable income.

- Secure fixed income payments unaffected by fluctuating interest rates and stock prices.

- Gain peace of mind knowing payments for a surviving spouse will continue without the delay of probate.

- Help an elderly parent, sibling, or other person in a tax-advantaged manner.

For seniors age 65 or older, charitable gift annuities simply provide the highest guaranteed returns available today. When the income tax deduction and the tax-free payment portion are taken into account, the overall effective rate can be considerable. Consider the following examples based on a $10,000 gift and current applicable federal rates with immediate payments:

If you would like to support ICR’s ministry but still need ongoing income, please prayerfully consider a gift annuity. ICR requires a minimum gift of $10,000 and can only offer CGAs to people age 65 or older (or deferred until age 65). Since rates increase by age, ICR would be happy to design a customized proposal for your consideration. Simply contact us at 800.337.0375 or stewardship@icr.org and provide us with your name, birth date, state of residence (not all states qualify), and the gift amount you are considering. We will be delighted to do the rest.

* Mr. Morris is Director of Donor Relations at the Insti-tute for Creation Research.